There is a quiet shift happening in small towns and big cities alike. Women who once believed earning meant leaving home are now discovering something different — income does not always require a cubicle or a fixed 9-to-5 routine. Sometimes, it begins with a conversation at a neighbour’s house, a phone call to a relative, or a meeting over tea.

That is where the LIC Bima Sakhi opportunity fits in.

It does not promise overnight success. It does not guarantee a salary at the end of the month. What it offers instead is something far more practical — a way to earn with dignity, on one’s own time, without abandoning family responsibilities.

A woman who has completed Class 10, whether she is 22 or 62, can apply. There is no glamour attached to it. No dramatic corporate ladder. Just steady work, relationship-building, and the possibility of long-term financial independence.

And sometimes, that is exactly what makes it powerful.

What Does a LIC Bima Sakhi Actually Do?

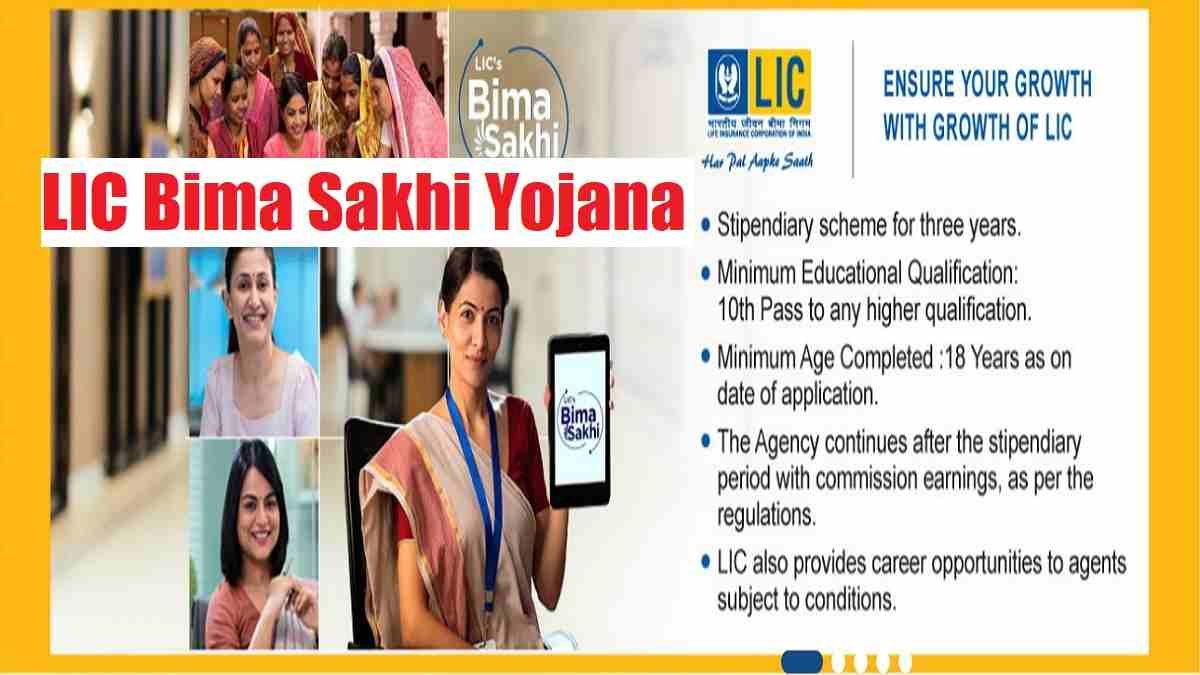

A LIC Bima Sakhi, also known as a Women Career Agent, works as an authorised insurance advisor with the Life Insurance Corporation of India. On paper, the job sounds straightforward: guide individuals and families in choosing life insurance policies suited to their needs. In reality, it is far more personal than that.

The work revolves around listening. People talk about their worries — children’s education, medical emergencies, retirement security. A Bima Sakhi explains policies in simple terms, answers repeated doubts patiently, and builds confidence slowly. Trust becomes the foundation of everything.

The role is commission-based, not salaried. Income depends on the number and type of policies sold and on long-term renewals. In the beginning, earnings may feel limited because building a network takes time. However, as relationships strengthen and policies renew year after year, income becomes more stable. For many women, what starts small grows steadily with persistence.

How to Become a LIC Bima Sakhi: The Step-by-Step Journey

Understanding how to become a LIC Bima Sakhi is not complicated, but it does require seriousness and commitment.

The process begins online through the official LIC website. Applicants need to locate the section related to Women Career Agents or Bima Sakhi registration and complete the application form with accurate personal details, including name, date of birth, contact information, and residential address. Accuracy matters because further communication depends on these details.

During registration, candidates select their nearest LIC branch. This branch becomes the primary contact point and guides them through the next stages. Usually, there is direct communication from branch officials who explain expectations clearly before moving forward.

After the application is reviewed, candidates must complete mandatory training prescribed by the Insurance Regulatory and Development Authority of India (IRDAI). This training introduces insurance fundamentals, regulatory guidelines, ethics, and product knowledge. For many women, this training becomes the first structured step into the financial services world.

Once the training is completed, the candidate must clear the IC-38 examination. This certification exam is compulsory to become a licensed insurance agent in India. Passing it confirms that the applicant understands the professional and ethical responsibilities involved.

After successfully clearing the examination and receiving branch approval, the candidate is issued an official LIC Agent Code. Only then can she formally begin working as a LIC Bima Sakhi.

Eligibility and Basic Requirements

The eligibility criteria are intentionally simple. Applicants must have passed at least Class 10 from a recognised board. The age limit ranges from 18 to 70 years, making the opportunity accessible to young aspirants as well as older women seeking financial independence.

However, close relatives of existing LIC agents or employees, including spouse, parents, children, and siblings, are not eligible to apply under this scheme. This ensures organisational transparency.

The approximate total cost for registration and examination is around ₹650. Compared to many career options that demand high investment, this entry cost remains modest.

Income Reality and Long-Term Potential

Since this is a commission-based role, income varies. Earnings depend on how many policies are sold, the premium value, and renewals in subsequent years. There is no guaranteed monthly salary.

In the early phase, patience becomes essential. Building credibility in the community takes effort. Not every meeting converts into a sale. Some clients need time. Some conversations lead nowhere. But consistency changes outcomes.

Renewals are what make this career sustainable. A policy sold today can continue generating commission annually. Over time, this creates a steady income stream. With dedication and genuine relationship-building, many women turn this opportunity into a long-term profession rather than a temporary engagement.

Occasionally, performance-based incentives or special schemes may be introduced, but long-term earnings always depend on sustained effort.

Why this Path Appeals to Many Women

Flexibility remains the strongest advantage. There are no fixed office hours or mandatory attendance requirements. Work can be planned around family responsibilities and personal schedules.

The credibility of LIC also plays a major role. Representing one of India’s most trusted financial institutions enhances confidence and social recognition. For many women, the role provides not only income but also identity and respect within the community.

Beyond financial returns, the journey builds communication skills, financial awareness, and professional confidence. Many women begin hesitantly but grow into strong advisors over time.

Final Thoughts

Knowing how to become a LIC Bima Sakhi is about more than completing an online form or passing an exam. It is about recognising a practical opportunity that aligns with real-life responsibilities while offering genuine financial growth.

The path is structured but accessible. The requirements are simple. The investment is modest. What ultimately determines success is consistency, patience, and the ability to connect with people honestly.

For women seeking financial independence without stepping away from their homes and families, this role offers something steady and real — progress built conversation by conversation.

—-Amit Sinha